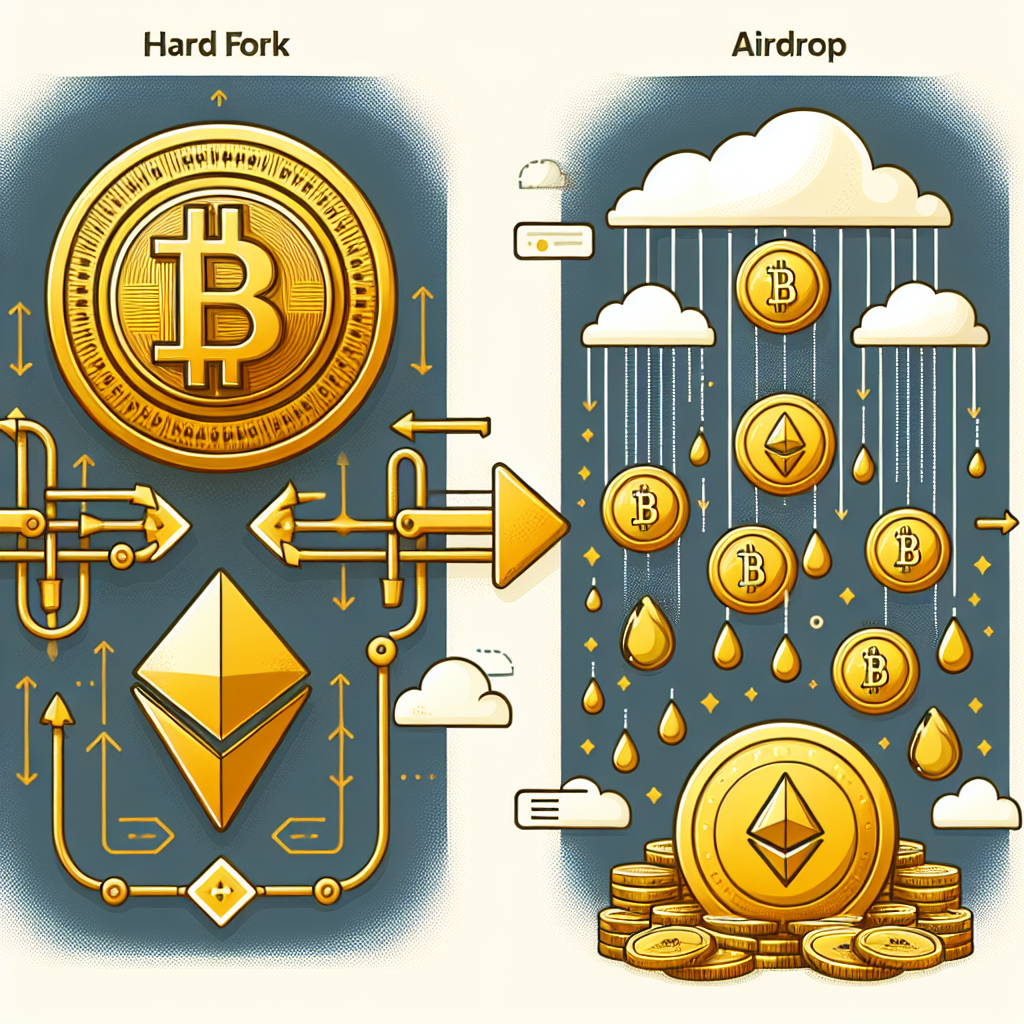

When programming modifications cause a blockchain to diverge permanently, a hard fork occurs. Airdrops, on the other hand, involve the direct delivery of new cryptocurrency tokens into users’ wallets to spark interest and attention.

Due to programming adjustments that render it incompatible with earlier versions, a blockchain experiences a hard fork. This division leads to two routes: one following the new blockchain, and the other retaining the original blockchain.

A Glimpse into Hard Fork Mechanics

Developers behind a project sometimes create a version that doesn’t support previous iterations, resulting in a hard fork. Typically, these occur after amicable discussions among the development team, network members, and investment communities. Occasionally, hard forks arise when factions within these groups seek changes others resist.

This divergence results in two distinct blockchain copies. The previous chain tends to continue unchanged, whereas the new chain adopts modified protocols and code adjustments. For the latest version, network node hosts must update their nodes. Failing to update results in exclusion from the new ecosystem. This update process can function as a voting mechanism, with the success of changes depending on the majority of nodes participating.

Contrary to disputes or major code alterations, some hard forks stem from attempts to create a similar or modified cryptocurrency under a new name.

Curious Insight

When hard forks happen, they often result in new tokens being allocated to the wallets of individuals holding the original token. Unlike an airdrop, this occurs because the blockchain has been duplicated and changed. Owning one coin before a hard fork means you’ll automatically possess another from the new chain, both linked to your wallet.

Some of the most talked-about moments in cryptocurrency history feature hard forks. A famous example is the division of Bitcoin. Over time, numerous Bitcoin forks have emerged, though most have not achieved significant success.

The Nature of Airdrops

An airdrop differs by distributing new cryptocurrency to numerous wallets, primarily as a strategy to generate curiosity and market engagement. Publicly accessible wallet addresses enable developers to design blockchains to deposit coins to existing wallets. Consequently, holders of bitcoin, ether, or other cryptocurrencies may unexpectedly discover new tokens in their wallets, often without prior notice. Some within the digital currency sphere view airdrops as largely unproductive, due to the oversaturation of coins they create.

Recipients of these complimentary tokens frequently attempt to sell them. If enough individuals succeed in offloading these free tokens, the new token’s value typically plummets considerably. Most airdropped cryptocurrencies fail to garner favorable attention from investors, as they seldom offer novel or groundbreaking features. Nevertheless, some have thrived, such as UniSwap, dYdX, Arbitrum, and Apecoin.

Evaluating the Value of Airdrops

Are Airdrops a Waste of Time?

Often, they can be. However, not all airdrops are futile. Success stories exist, hinging on factors like use cases, target audience, and perceived benefit.

Can You Actually Make Money From Crypto Airdrops?

If the venture successfully heightens awareness and activity as developers intend, there is potential to profit from airdrops.

Is a Hard Fork Good or Bad?

Opinions on hard forks vary, contingent upon the changes and their impact on a blockchain and its cryptocurrency. They can be perceived as either positive or negative.

Hard forks entail alterations in blockchain programming that disrupt compatibility with older versions. In contrast, airdrops involve introducing new cryptocurrencies to wallets to generate interest and engagement in particular projects.